Previously, Business equipment financing was provided exclusively by banks and original equipment manufacturers (OEMs).

Today, QuickFi enables payments, payroll, and other non-bank financial firms serving small and medium businesses (SMB) to offer nearly instant business equipment finance and leasing services throughout the U.S. and Canada.

QuickFi enables comprehensive, 50-state equipment financing capability without expensive software or financial systems and without hiring dozens of specialized finance employees. QuickFi provides a complete, end-to-end solution, enabling a partner financial firm to control the customer financing experience and facilitate customer lease and loan transactions.

The QuickFi embedded finance platform dramatically improves the SMB financing experience, creating additional revenue opportunities and unlocking massive marketing and repeat business potential.

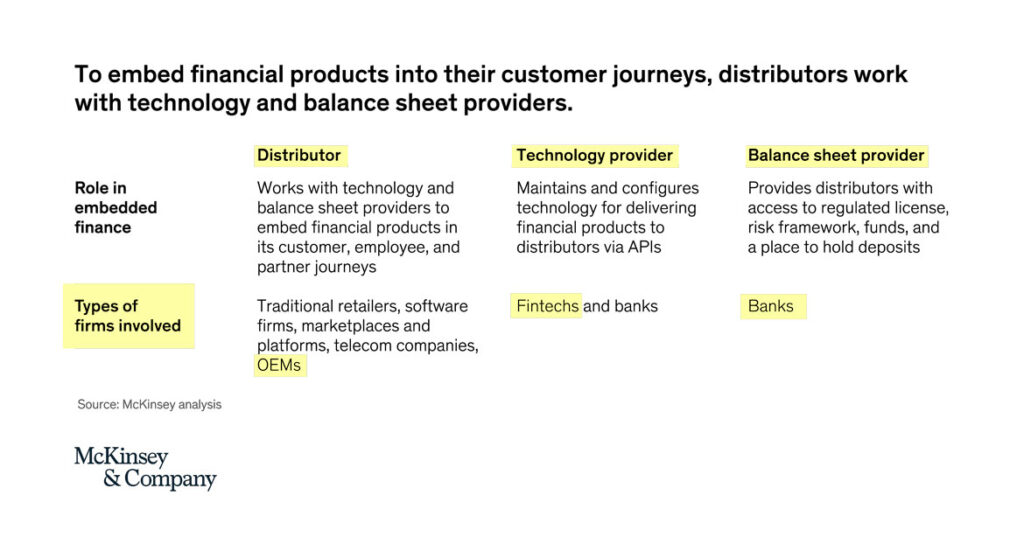

McKinsey & Company predicts that OEMs, fintech companies, and banks will collaborate to establish embedded finance delivery models (See McKinsey & Company Chart, below).

QuickFi delivers all the benefits of a traditional finance company without the cost, risk, or complexity.

Additional QuickFi benefits include:

- Improved Borrower Experience – QuickFi borrowers enjoy a seamless, 100% digital, nearly instant equipment financing experience. QuickFi creates significant marketplace differentiation compared to banks and captive finance company offerings.

- The QuickFi Finance Partner Controls the Customer Experience and Lease or Loan Terms – Because traditional financing processes are often the weakest aspect of the customer equipment purchase experience, partner companies can significantly improve the experience of providing business equipment financing using QuickFi.

- Enhanced Related Sales – QuickFi makes it easy for equipment financing customers to obtain insurance and related financial services through the partner’s core offerings. Repeat equipment financing transactions may be facilitated in minutes, allowing a manufacturer’s best customers to transact seamlessly as needed. Because the financial partner controls the QuickFi platform, credit data regarding customer credit and payment performance is available for partner marketing and sales initiatives. Watch a QuickFi Customer Testimonial

- No Risk or Capital Investment Required – QuickFi enables financial partners to fund customer leases and loans with partner capital or third-party banks and finance companies. With QuickFi, the financial partner controls the offerings, even if the capital comes from third-party banks.

- Manufacturer Captive Finance Company Option – Interested OEMs using QuickFi can quickly transition from third-party bank financing to establish a 50-state U.S. (plus Canada1) captive finance capability (enabling the OEM to lend its own money). Without purchasing costly software or hiring dozens of sales, operations, credit, collections, accounting, and compliance professionals, an OEM using QuickFi can offer 50-state U.S. (plus Canada) financing through the 100% digital, QuickFi embedded finance platform.

- Treasury Flexibility – The output of the QuickFi platform is digital chattel paper, which is deposited securely in the partner’s digital vault. The terms and conditions contained in the digital chattel paper are widely accepted among banks and finance companies. QuickFi digital lease or loan transactions (from $5 thousand to $5 million each) may be easily transferred to US banks for over-exposure, credit management, capital replenishment, or risk management reasons. For partners that use QuickFi to operate a captive finance business, the partner may wholesale loans and leases to third-party banks and finance companies while maintaining servicing of those loans and leases (still serviced in the partner’s name) on the QuickFi platform. In addition, securitization is available as a wholesale funding option for partners operating a larger volume lending operation on QuickFi.

Business equipment financing is a huge market. In the U.S. alone, over $1.6 trillion of business equipment is financed annually.

Financial partners use QuickFi to gain access to valuable customer credit and repayment data, which improves the capacity for future, partner AI and marketing initiatives.

$1.6 Trillion Dollars of Business Equipment Financed Annually

QuickFi has an average TrustPilot score of 4.9 on a scale of 5.0. QuickFi dramatically improves the buying experience for SMBs who acquire and finance business equipment. This massively differentiated SMB borrowing experience accrues to the reputation of the financial partners operating the QuickFi platform (with partner private label branding).

QuickFi’s patented technology is the only B2B embedded finance solution in the market today. QuickFi’s proprietary technology enables partner financial companies to almost instantly establish a full-service digital lending platform with compliance in all 50 states and Canada.2

QuickFi requires no upfront cost and no long-term contractual commitment. QuickFi costs less than one-third (1/3) per completed financing transaction compared with the per transaction cost of processing the same transaction on the traditional delivery model.

Accenture, Bain & Company, and McKinsey & Company have advised banks and global OEMs regarding the dramatic potential for embedded finance to transform business equipment financing. Because banks have been slow to act, this creates a huge market opportunity for non-bank financial firms to enter business equipment finance with a massively differentiated, embedded finance offering.

Over the next five years, embedded finance for SMEs will displace traditional sales distribution models. Bain and Company suggest, “Demand [for embedded finance] will grow because the proposition promises to improve customer experiences and financial access, along with providing cost-reduction.” Now is the time for banks and OEMs to decide how to offer embedded equipment finance, according to Bain.

Request information about implementing a revolutionary, new, 100% digital, nearly instant, embedded equipment finance solution.