The revolutionary QuickFi platform

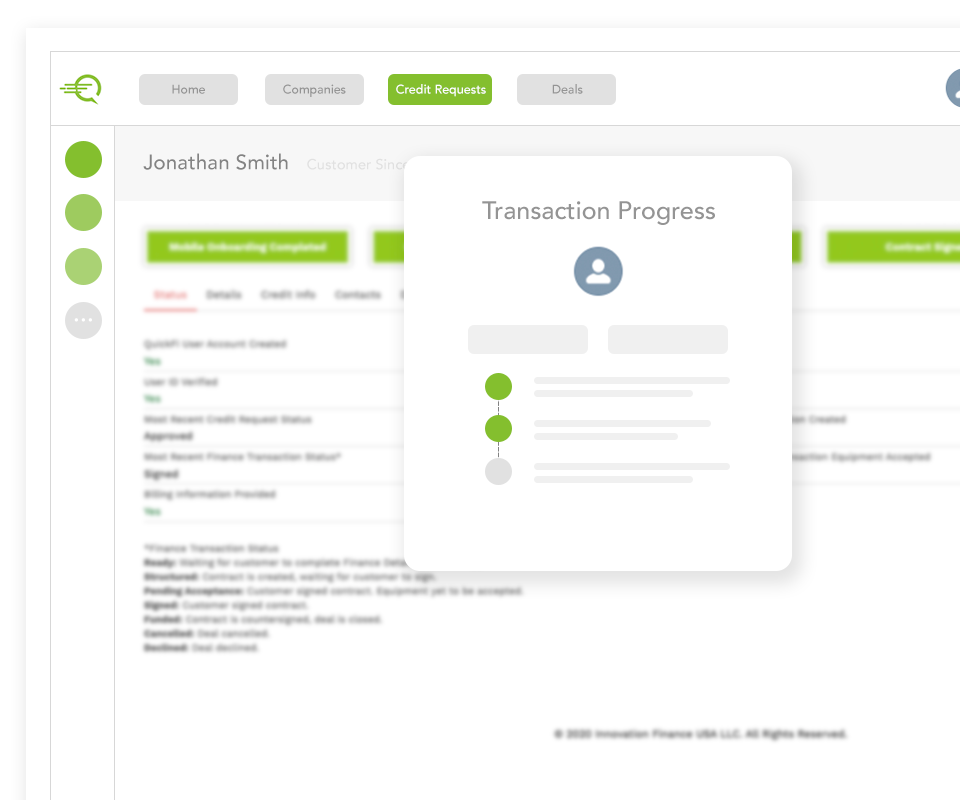

QuickFi® by Innovation Finance USA LLC, is the world’s first 100% digital, mobile, borrower-self-service business equipment financing platform.

QuickFi enables business equipment buyers to almost instantly establish and consummate business equipment leases and loans ranging from $5,000 to $5,000,000 USD. Leading equipment manufacturers use the patented QuickFi system to initiate and complete equipment purchaser financing in just 3 minutes.

Your brand powered by the transparency and trust of the QuickFi platform

Your brand reputation is important. QuickFi was built with an obsession for improving the borrower experience, to enhance your brand. Our strategy is simple: we put ourselves in the borrower’s shoes and we imagine a better more customer-focused equipment financing experience.

We evaluated all the emerging, new exponentially advancing technologies and we considered how each one could enable an entirely new business model that wasn’t possible just a few months or years ago. When you implement QuickFi technology, you are implementing transparency and trust.

Your Platform POWERED BY QUICKFI

| Cost | No upfront cost – deploy capital to other high-ROI initiatives |

| Time | Roll out 100% digital end-to-end platform in as little as two weeks |

| Expertise & Staffing | Leverage experienced & established credit underwriting, customer support, operations, risk, compliance, billing, collections and accounting expertise |

| Systems | Save on overhead costs with a state-of-the-art 100% digital platform (incorporating facial recognition, drivers’ license authentication, artificial intelligence, blockchain, and the latest in cloud and mobile technologies) white-labeled with your brand and managed by your organization |

| Product | Maintain strategic flexibility by adopting a platform that grows with you to allow true captive operations, or continued outsourcing of the financing |

| Availability | Obtain 24/7/365 equipment financing capabilities to support your sales channels |

QuickFi’s patented technologies include biometric authentication, drivers’ license verification, AI/ML, blockchain, and other advanced security, mobile and cloud technologies. QuickFi reduces equipment manufacturer sale cycle times by dramatically simplifying and accelerating the financing process.

Additional QuickFi platform components facilitate unlimited, manufacturer initiated business borrower pre-approvals, thereby improving margin on equipment sales. Likewise, QuickFi’s pre-qualification criteria helps manufacturers maximize the benefits of manufacturer subsidized financing programs.

QuickFi also provides full financing integration with existing, manufacturer business equipment web sales platforms. By easily integrating QuickFi into existing web sales platforms, shopping cart contents can be leased or financed by equipment buyers in minutes (24/7/365), with the completed financing immediately returned to the manufacturer shopping cart for fulfillment.

Success with QuickFi

Scott, a sales manager at a global equipment manufacturer, knows that when completing an equipment sale with a prospective buyer, timing can mean everything. A pre-approved financing option available at the point of sale can mean the difference between winning or losing the sale.

When Scott goes into equipment sales presentations to pitch new equipment to prospective customers, he needs a financing solution that is simple and easy for his customers. QuickFi’s 24/7 mobile financing solution helped Scott close his sales, faster.

Trusted by the world’s leading equipment manufacturers

|

|

|

|

|