Simple & secure solution for your business

QuickFi offers a secure, encrypted digital credit application option, which may be be completed by the equipment buyer to obtain an instant credit decision, from any web-connected device, anytime, from anywhere.

Features

The QuickFi digital credit application gives you flexible options that work for your business.

Custom Branded Digital

Credit Application

Protected Credit Information

Instant Digital Credit

Application PDF Generation

Notifications at Every

Stage of the Process

Sales Networks with Ease

The QuickFi Partner Portal

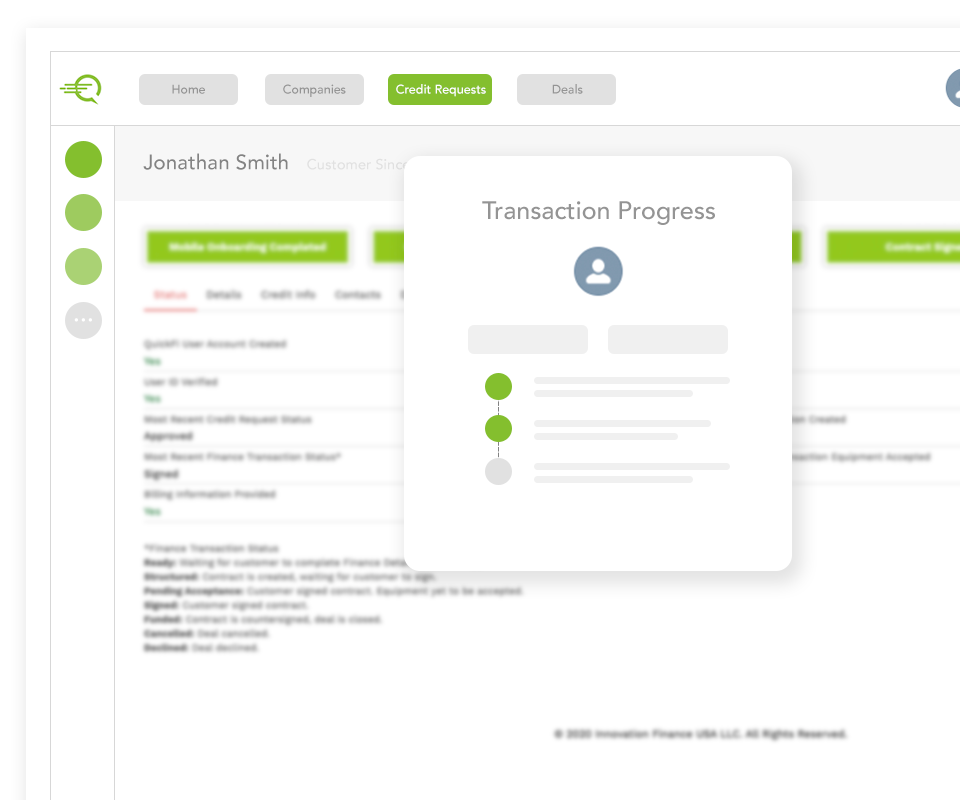

Control every stage of the process

Access one simple dashboard, showing all of your customer requests, approvals, and completed transactions in a single view.

Instant status updates

Know where your customers are in every transaction at all times.

Direct notifications to your customer

Move your customers along in the financing process with direct notifications to get the documents you need directly from your customer.

Robust reporting capabilities

Get instant reporting on all of your customer financing transactions.

24/7/365 access

Access the portal anytime, anywhere, to do business at your convenience.

Trusted by the world’s leading equipment manufacturers

|

|

|

|

Why do Equipment Manufacturers Love QuickFi?

QuickFi® by Innovation Finance USA LLC, is the world’s first 100% digital, mobile, borrower-self-service business equipment financing platform. QuickFi enables business equipment buyers to almost instantly establish and consummate business equipment leases and loans ranging from $5,000 to $5,000,000 USD. Leading equipment manufacturers use the patented QuickFi system to initiate and complete equipment purchaser financing in just 3 minutes.

Additional QuickFi platform components facilitate unlimited, manufacturer initiated business borrower pre-approvals, thereby improving margin on equipment sales. Likewise, QuickFi’s pre-qualification criteria helps manufacturers maximize the benefits of manufacturer subsidized financing programs.

QuickFi also provides full financing integration with existing, manufacturer business equipment web sales platforms. By easily integrating QuickFi into existing web sales platforms, shopping cart contents can be leased or financed by equipment buyers in minutes (24/7/365), with the completed financing immediately returned to the manufacturer shopping cart for fulfillment.

QuickFi’s patented technologies include biometric authentication, drivers’ license verification, AI/ML, blockchain, and other advanced security, mobile and cloud technologies. QuickFi reduces equipment manufacturer sale cycle times by dramatically simplifying and accelerating the financing process.

About QuickFi

QuickFi incorporated emerging new technologies (such as artificial intelligence, facial recognition, and blockchain) to create an entirely new financing business model expediting the equipment sale process with advanced pre-qualification capabilities instant 24/7 credit and documentation processing and next day funding — all with a nearly instant, dramatically improved borrower experience.

QuickFi provides significant differentiation and competitive advantage against all manufacturers employing the traditional equipment financing model.