B2B Embedded Lending Platform Powered By Agentic AI

QuickFi® delivers the industry’s first B2B embedded lending platform powered by agentic AI, dramatically simplifying and accelerating the financing process for banks. Our autonomous, intelligent platform enables financial institutions to scale efficiently without adding headcount.

QuickFi® delivers the industry’s first B2B embedded lending platform powered by agentic AI, dramatically simplifying and accelerating the financing process for banks. Our autonomous, intelligent platform enables financial institutions to scale efficiently without adding headcount.

Scalable, frictionless financing

Advanced financing capabilities to help your bank grow.

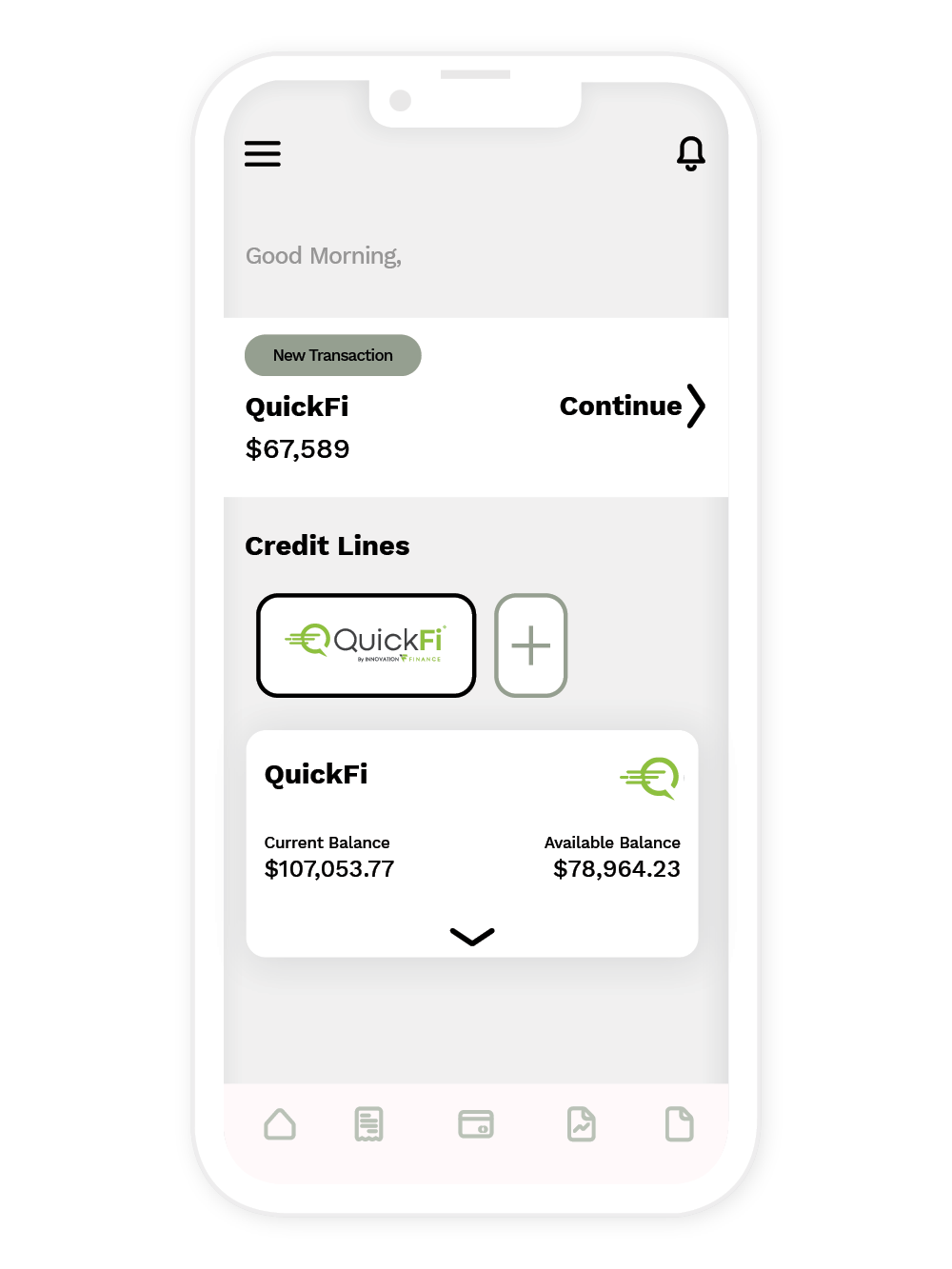

QuickFi’s patented technologies include biometric authentication, drivers’ license verification, KYC & KYB technology, facial recognition, AI/ML, process automations, and other advanced security, mobile and cloud technologies available instantly for your bank.

QuickFi’s patented technologies include biometric authentication, drivers’ license verification, KYC & KYB technology, facial recognition, AI/ML, process automations, and other advanced security, mobile and cloud technologies available instantly for your bank.

Stop fraud, stay compliant

to help your bank solve risk.

QuickFi leads with solutions for exceeding your bank’s identity, fraud, compliance, and credit risk parameters throughout your customers’ lifecycle.

QuickFi leads with solutions for exceeding your banks

identity, fraud, compliance, and credit risk parameters

throughout your customers’ lifecycle.

Bank-level security and SOC2 certified

Fraud solutions to future-proof your risk tech stack

Understanding bank’s regulatory requirements to stay compliant

QuickFi is NOT a marketplace. We provide our bank partners with dedicated access to our global manufacturer partners. We do not auction or market the same program paper to multiple lenders.

All credit criteria and pricing is established by the bank.

QuickFi is available to our bank partners to help secure new global manufacturer financing partnerships based on the differentiation QuickFi provides.

QuickFi’s only cost to the bank is a flat fee per booked deal ($799), and a monthly servicing charge ($20). This is less than 1/3 the cost of the bank’s existing cost structure per the ELFA survey of industry activity.

No interest or lease income is retained by or shared with QuickFi … it is all retained by the bank partner.

QuickFi has multiple global patents and QuickFi currently serves multiple global manufacturers in all 50 states.

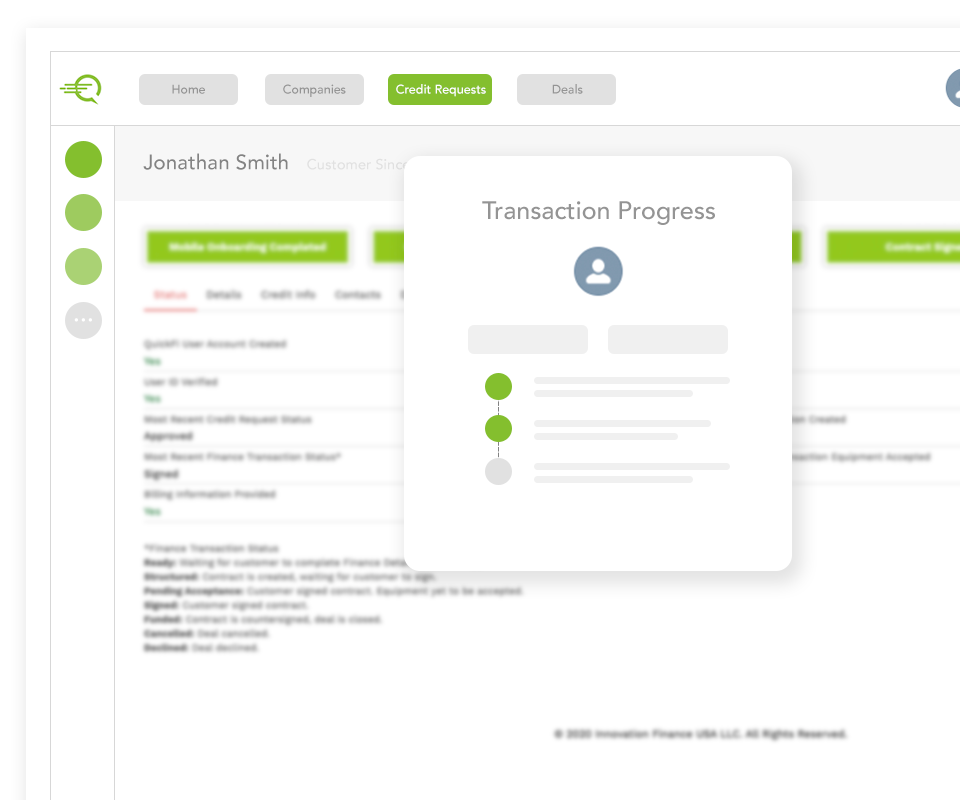

Scale your equipment lending operation, without adding headcount

QuickFi provides an end-to-end platform supporting the entire equipment finance organization.

Recent QuickFi News & Media

QuickFi® Wins Best in Show at Equipment Finance Connect 2025

→ Read More

QuickFi Named Finalist in Two Categories at the 2025 Banking Technology Awards USA

→ Read More

QuickFi Named “Best Overall LendTech Company” in 9th Annual FinTech Breakthrough Awards Program

→ Read More

QuickFi Wins Second Consecutive “BIG Innovation Award” for their Embedded Lending Platform

→ Read MoreTransform Your Bank Lending Operations

Experience the power of the industry’s first B2B embedded lending platform powered by agentic AI. QuickFi delivers unmatched efficiency, security, and scalability for banks looking to modernize their equipment financing operations.