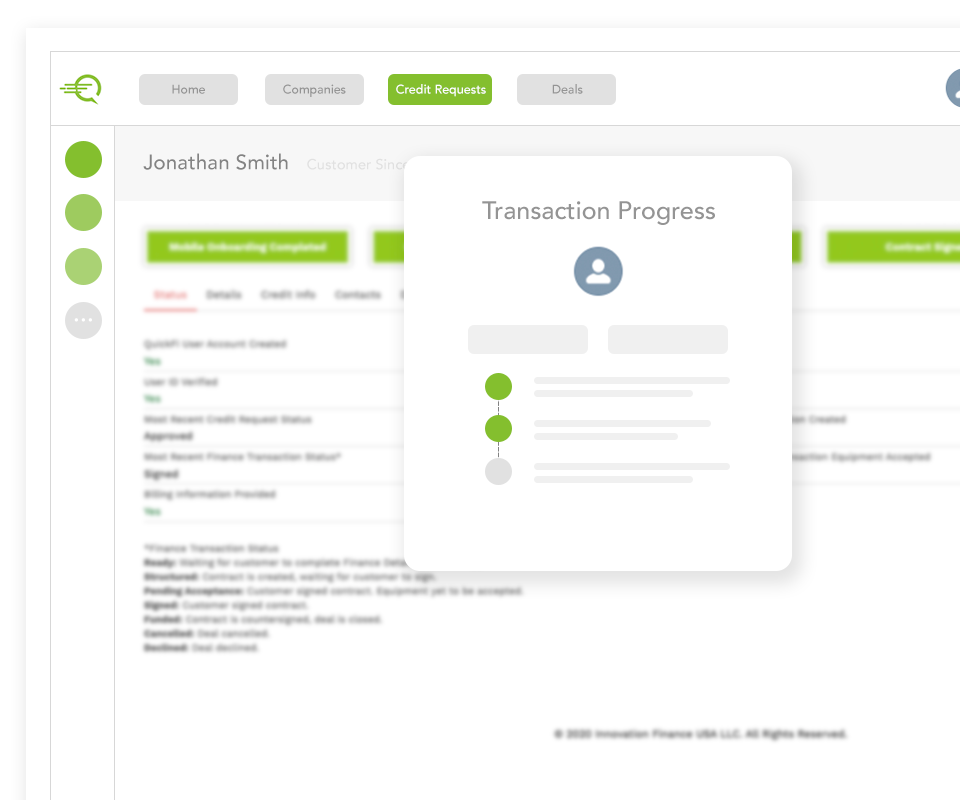

Business equipment manufacturers can adopt the end-to-end, 100% digital, QuickFi business equipment financing platform to sell more equipment, faster, while dramatically improving the equipment buyer’s experience.

Scalable, frictionless financing

|

|

|

|

|

Leading equipment manufacturers use the patented QuickFi platform to initiate and complete equipment purchaser financing in just minutes. QuickFi eliminates the need to manage complex equipment leasing software systems and eliminates costly servicing, collection, customer service, IT, security and other staff costs.

With reduced operating cost, faster cycle times, and improved borrower satisfaction, QuickFi increases both bottom and top line equipment financing performance.

QuickFi’s patented technologies include:

Biometric authentication, drivers’ license verification, KYC & KYB

Advanced security, mobile and cloud technologies

AI/ML, process automations

QuickFi gives business equipment manufacturers advanced financing capabilities not available elsewhere. Pre-approve business equipment purchasers (without cost or obligation) on every potential sale, to increase closing rates, shorten timing to close, and to improve product sale margin. With pre-approval capabilities, QuickFi partners close more sales, faster, at higher margin.

QuickFi integrates seamlessly with internal sales teams and dealer or distributor networks to facilitate credit pre-approval and nearly instant, 24/7, borrower self-service loan completion with next day funding.

QuickFi also offers a secure, encrypted digital credit application option, which may be be completed by the equipment buyer to obtain an instant credit decision, from any web-connected device, anytime, from anywhere.

Global manufacturers selling equipment directly to business on the Internet can now integrate an existing web shopping platform with QuickFi to enable round-the-clock, instant financing capability in a web-based equipment selling model.

As an OEM, your sales model focuses on the initial transaction. But what if every customer could become a source of recurring revenue for years to come? QuickFi’s financing platform doesn’t just help you close more deals—it fundamentally transforms how you generate value from each customer relationship

Cost

No upfront cost – no long-term commitment — pay only for funded transactions — hold the loans and leases yourself, or outsource the entire financing process to QuickFi.

Expertise & Staffing

Leverage experienced credit underwriting, customer support, operations, risk, compliance, billing, collections and accounting expertise — without expensive software investments in legacy, non-digital software platforms — by establishing a single, 100% digital business partnership with QuickFi.

Technology

Implement a 100% digital

platform (incorporating facial recognition, drivers’ license

authentication, artificial intelligence, blockchain, and other cloud & mobile technologies) white-labeled

with your brand and managed by your organization.

Availability

Obtain 24/7/365 equipment financing capabilities to support your

sales channels

QuickFi® is covered by one or more US & foreign patents. | Privacy Policy

QuickFi is a financial technology company and not a bank. Banking services are provided by QuickFi’s partner banks.

© Innovation Finance USA LLC , All Rights Reserved.

QuickFi is a financial technology company and not a bank.

Banking services are provided by QuickFi’s partner banks.

© Innovation Finance USA LLC,

All Rights Reserved.

QuickFi® is covered by one or more US & foreign patents. | Privacy Policy