AI Strategy for Secured Lending

NOVEMBER 11, 2024

Why are most AI projects relegated to chatbots and inbound call processing?

There are compelling opportunities in commercial lending for AI solutions in compliance and risk management, real-time credit decision making, predictive analysis, forecasting, security, fraud prevention, predictive marketing, offer timing and presentment. But they all require abandoning the 100-year-old sales delivery model in favor of a digital embedded lending delivery model.

The challenge facing banks and commercial lenders today is that bank systems are disconnected from the customer. Sales-driven business models, which have incrementally improved with decades of costly CRM enhancements, are a dead end for the majority of emerging AI use cases.

Steven Rosenbush describes this problem in his October 2024 Wall Street Journal article, Companies Look Past Chatbots For AI Payoff, explaining that most powerful AI capabilities are only available to companies that have established modern, digital workflows.

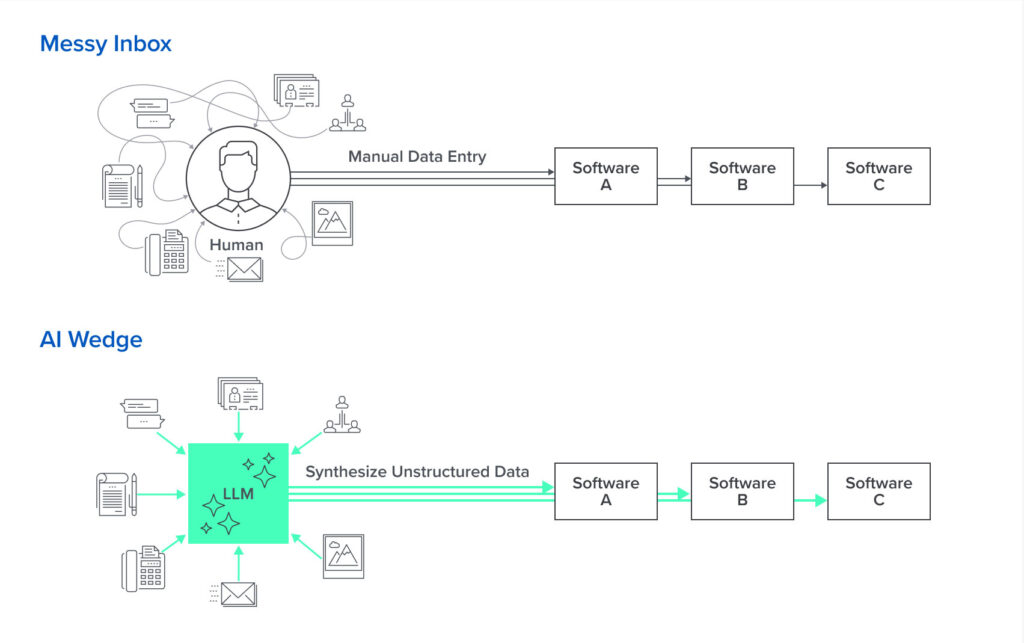

Sales-driven, CRM-centric processes route customer communication through people who verbally communicate with customers and manually enter updates into the company’s CRM software or other system of record. These manual workflows are not conducive for AI.

Andreessen Horowitz has been aggressively investing in companies that address this challenge. The “messy inbox problem” identified by Andreessen Horowitz, exists where businesses grapple with unstructured information and fragmented workflows on the sales or inbound end of the company’s value chain.

ARTICLES REFERENCED

Wall Street Journal | Companies Look Past Chatbots for AI Payoff

Andreessen Horowitz | The Messy Inbox Problem: Wedge Strategies in AI Apps

Andreessen Horowitz | Input Coffee, Output Code: How AI Will Turn Capital into Labor

David Haber of Andreesen Horowitz describes this problem in the medical profession:

“They still rely on an army of administrative staff to manually gather faxes, sift through emailed PDFs and phone messages, and input patient data into electronic medical records. And it’s not just in medicine. Every day, millions of small businesses in industries that run the gamut from law and insurance to freight and oil & gas, also waste countless hours synthesizing waves of unstructured information and entering data into industry-specific systems of record to qualify their prospective customers and initiate a number of downstream workflows.”

Andreessen Horowitz | The Messy Inbox Problem: Wedge Strategies in AI Apps

The result is an inability to employ any meaningful A.I. solutions, except for chatbots to support inbound customer telephone calls. By comparison, companies that transition to a digital delivery model (such as embedded lending) can employ a full range of highly impactful A.I. solutions throughout the enterprise.

Conventional equipment financing requires applicants to navigate a labyrinth of documentation, multiple intermediaries, and lengthy approval cycles. This delays the equipment sales process and results in fractured, inefficient, and undesirable customer experience. The fragmented nature of these tasks exemplifies the “messy inbox problem,” where unstructured data and disjointed processes hinder efficiency.

More importantly, thought leaders like Steven Rosenbush, David Haber and Alex Rampell believe these legacy workflows may preclude meaningful AI implementations. Given the speed and impact of AI technology advances, this ability to adopt AI could separate the winners from the losers.

There is a significant opportunity for lenders who address this challenge with new digital business models. David Haber says,

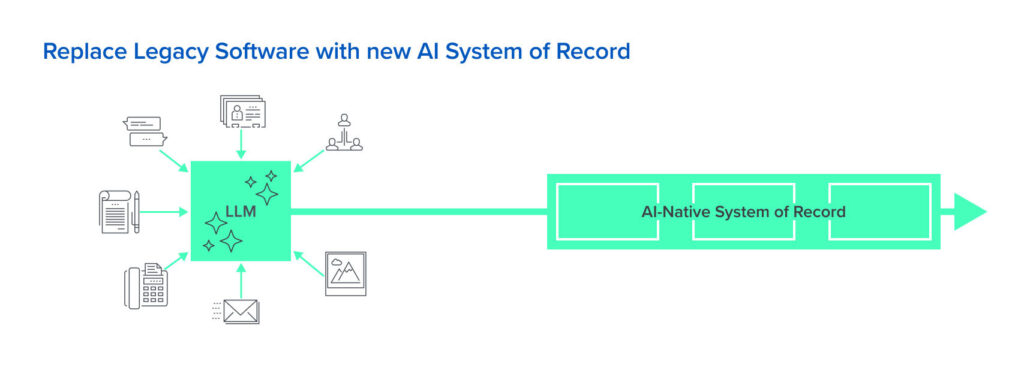

“For context, this ‘messy inbox problem’ typically sits at the top of the funnel for most white-collar work. By being able to replace human labor with LLMs, you’re effectively stepping in front of any existing downstream software systems. The ability to synthesize unstructured voice or text data and systematically extract relevant information earns you the right to initiate (and own) other downstream workflows.”

Andreessen Horowitz | Input Coffee, Output Code: How AI Will Turn Capital into Labor

The emergence of embedded lending — Integrating financial services into non-financial offerings — is changing the way customers interact with banks and financial institutions, and it enables lenders to quickly adopt a new, AI-friendly business strategy. Embedded lending represents a transition from the traditional financial sales model to borrower self-service at the point of sale. The direct digital connection to the customer that is established allows lenders to add AI capabilities throughout the entire lender value chain.

By digitizing the entire workflow—from application to approval—embedded lending platforms like QuickFi eliminate the need for manual intervention, thereby reducing errors and accelerating turnaround times. This approach not only resolves the immediate inefficiencies but also positions QuickFi to integrate seamlessly with other future AI capabilities. Embedded lending automats and simplifies the equipment financing process, while making it “AI ready.”

The direct customer connection and data capture are the precursor to more ambitious, future AI strategies. The combined benefits of embedded lending and broad AI integrations throughout the value chain will result in massive cost savings, hyper personalized offerings, instant analysis and decisioning, and a system of record that is dramatically improved and constantly evolving.

For lenders thinking strategically about the pre-AI competitive landscape, solving the messy inbox problem and preparing for broad AI adoption by transitioning to embedded lending may be the most significant strategy decision banks and finance companies can make today.

Accenture, Bain & Company, and McKinsey & Company have advised banks and global OEMs regarding the dramatic potential for embedded finance to transform business equipment financing.

Over the next five years, embedded finance for SMEs will displace traditional sales distribution models. Bain and Company suggest, “Demand [for embedded finance] will grow because the proposition promises to improve customer experiences and financial access, along with providing cost-reduction.” Now is the time for banks and OEMs to decide how to offer embedded equipment finance, according to Bain.

Request information about implementing a revolutionary, new, 100% digital, nearly instant, embedded equipment finance solution.