TECHNOLOGY

Are Your Bank’s Artificial Intelligence Ambitions Too Low?

Are Your Bank’s Artificial Intelligence Ambitions Too Low?

DECEMBER 6, 2023

Why do most banks’ artificial intelligence projects involve chatbots and inbound customer telephone calls? Is inbound telephone call processing representative of the potential for A.I. in commercial lending?

What happened to banks using A.I. in commercial lending to:

- Employ advanced loan processing,

- Improve credit adjudication, risk management, and compliance,

- Enhance data-driven decision-making,

- Improve scalability and more rapid adaptability to changing economic conditions,

- Enhance financial inclusion,

- Employ predictive analytics for better forecasting and

- Develop enhanced security and fraud detection?

If your bank’s systems are disconnected from your borrowers — because your lending business still operates a salesperson distribution model — your A.I. ambitions may be constrained to processing inbound customer telephone calls and other low impact projects.

10 AI LENDING INITIATIVES IN BANKS

Consider these ten A.I. lending initiatives that go well beyond chat bots and inbound call processing.

- Risk Management and Compliance

- Data-Driven Decision Making

- Competitive Advantage

- Scalability and Flexibility

- Enhancing Financial Inclusion

- Real-Time Processing and Instant Decisions

- Predictive Analytics for Better Forecasting

- Enhanced Security and Fraud Detection

- Integration with Other Technological Innovations

- Revolutionizing Loan Processing with A.I.

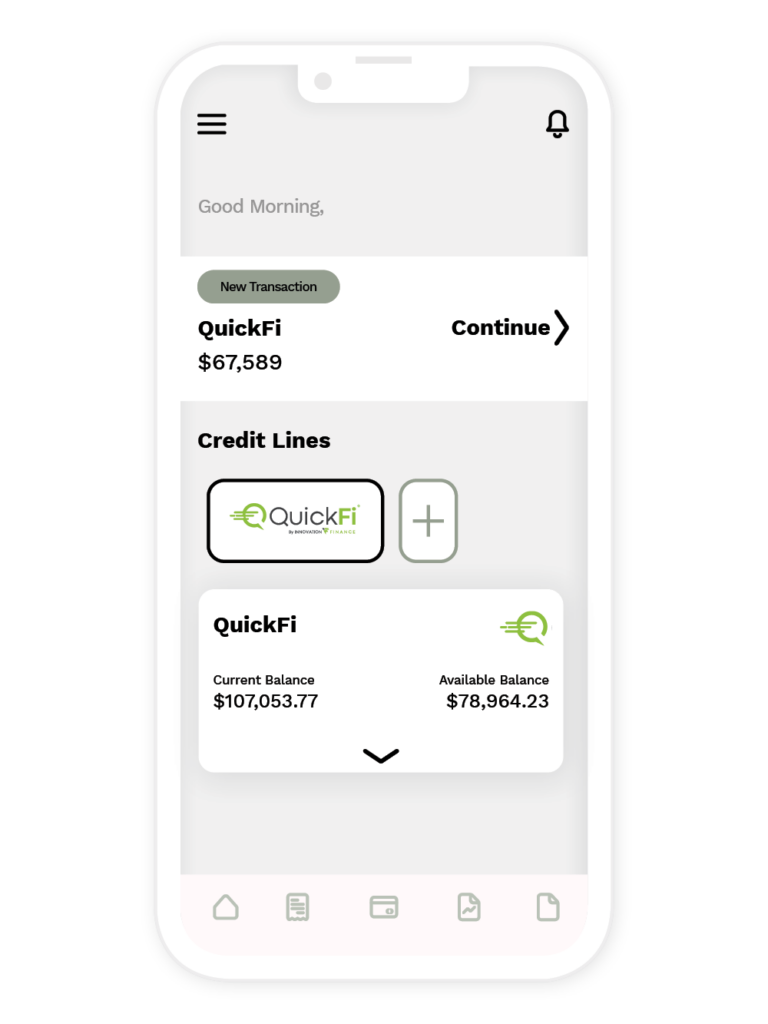

Is digital borrower self-service a prerequisite to most advanced A.I. projects in commercial lending?