Pricing, terms, & reporting

You can’t control what you can’t see. QuickFi® enables you to control your financing terms by providing you with unprecedented transparency. Within the QuickFi mobile app, everything you care about is clearly visible. Transaction interest rates, no fees, no hidden costs, amortization schedules, simple English contract copies, and ongoing account and payment details are accessible 24/7.

QuickFi’s mobile accessible platform leaves no room for confusion.

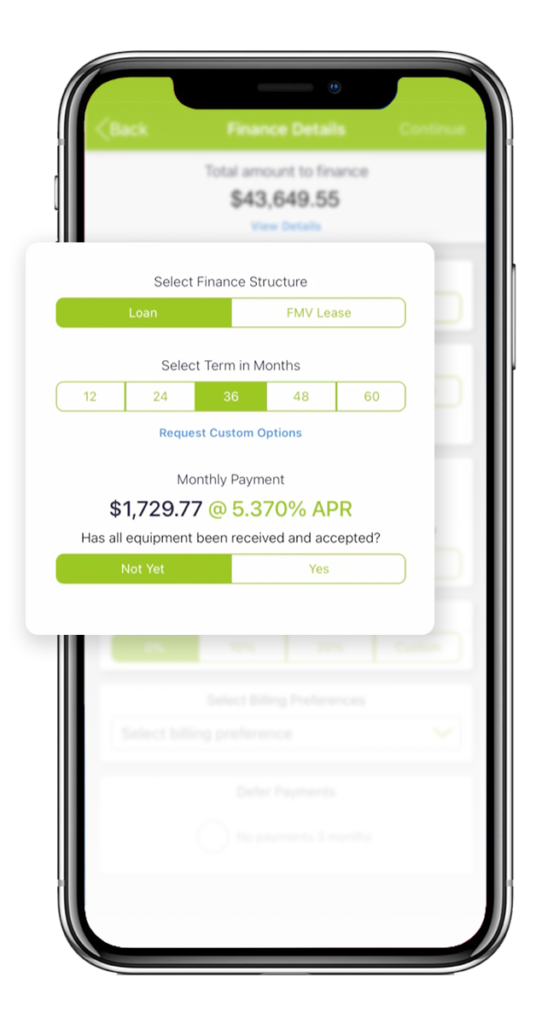

Low, fixed rates, with a stated APR all in the mobile app

Obtaining a business equipment loan with QuickFi® involves no finance salespeople or loan officers, so our overhead expenses to process equipment financing transactions are a fraction of the cost of other banks and finance companies. We pass these savings back to you in the form of lower rates, and you can relax, not having to deal with pushy finance salespeople.

Days or Weeks

Finance salesperson or account representative

Credit team

Pricing team

Documentation

Manual review

Decision

Multiple Signatures

Approval

Three Minutes

Fill out application

Choose term and structure

One digital signature

Straightforward Terms, Fixed Rates

12 to 72 month fixed rate financing.

No hidden fees.

No hidden charges of any kind.

Interest rates are disclosed to you on the QuickFi app, before you start the three-minute finance process.

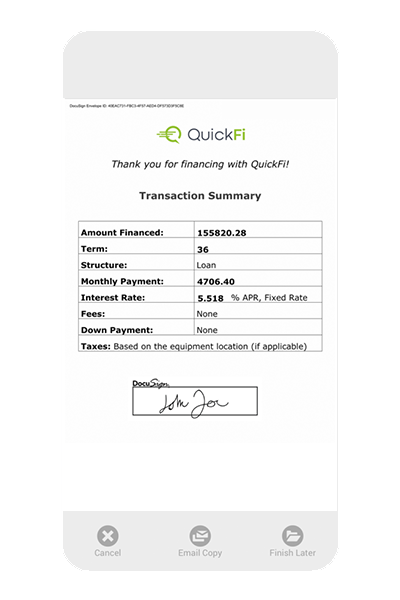

Simple Contract, One Signature

Export to review, share, or print with business colleagues, accountants or lawyers, before completing your transaction. We are confident they will be impressed with the terms you’ve obtained.

Clearly summarized terms and conditions.

One digital signature. QuickFi is that simple!

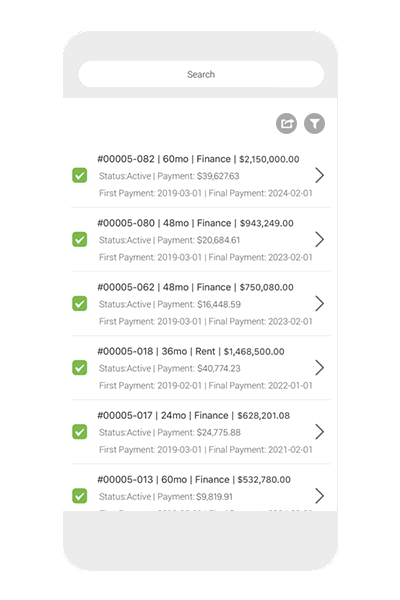

Accessible Reporting, Anytime

Finalized contracts, vendor invoice copies, amortization schedules and complete servicing capability is available to QuickFi customers 24/7/365 through the mobile application.

Easily view, filter, export, and share reports with others through the QuickFi mobile application.