Benefit Your Bottom Line with IRS Section 179

Businesses have ongoing tax incentives to acquire and install capital equipment. Taking advantage of the IRS Section 179 deduction could save you money during this tax year. Section 179 of the IRS tax code lets businesses deduct the full purchase price of qualifying equipment financed during the tax year, up to $1,040,000.

Instead of depreciating newly acquired equipment over several years, you can take the full deduction now and save real money on your bottom line. You need to purchase your equipment and have it in service by the end of the calendar year.

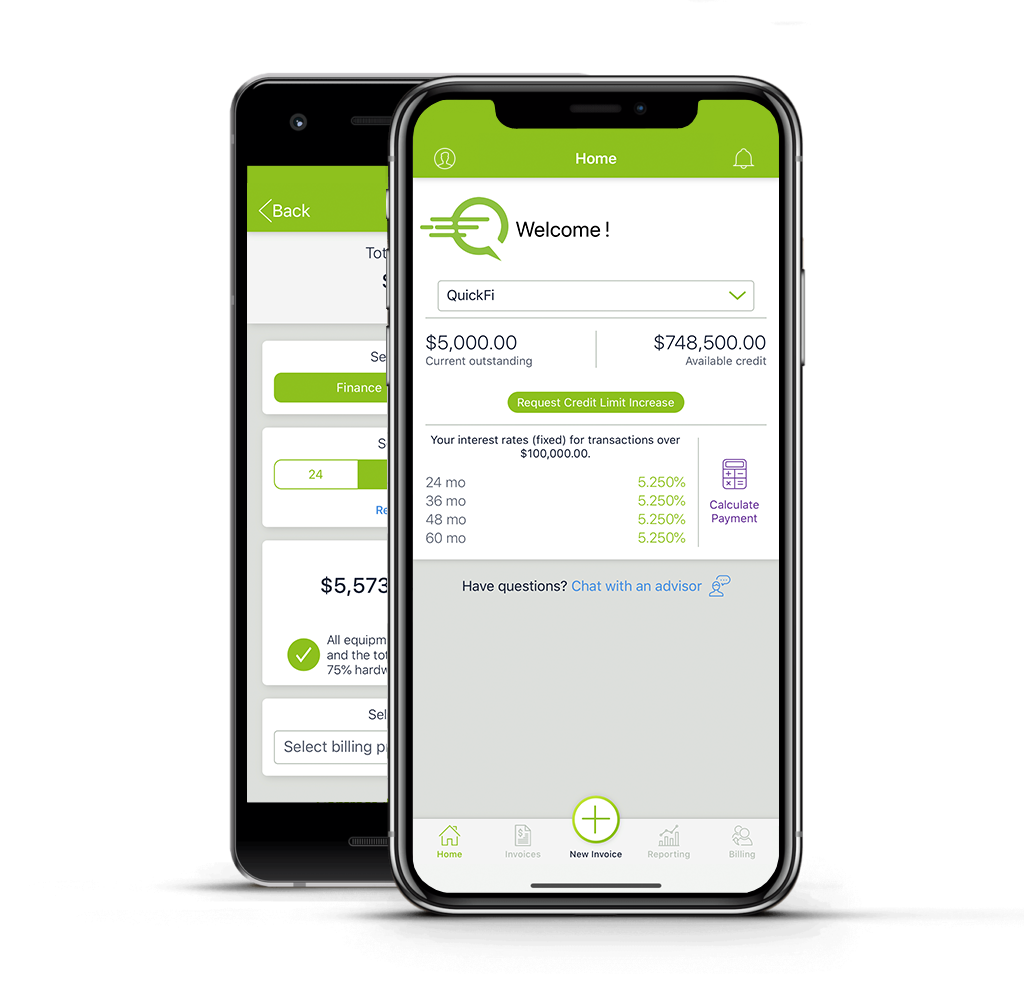

QuickFi can help your business take advantage of IRS Section 179 tax incentives so that you can get the equipment your business needs.

Contact QuickFi for More Details

What is the IRS Section 179 Deduction?

Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year, up to $1,040,000. When you buy a piece of qualifying equipment, you may be able to deduct the full purchase price on your business income tax return. The U.S. government created Section 179 to encourage businesses to spend money on equipment, and benefits small and mid-size businesses who spend less than $3.5 million per year for equipment.

How does it work?

When a business purchases qualifying equipment, the depreciation is typically written off over time. Many businesses prefer to write off the entire equipment purchase price for the year they purchase it. The ability to write off the entire amount in a years time, instead of waiting over the course of several years allows small and medium businesses to add more equipment in that year. For most businesses, the entire cost can be written-off on the 2020 tax return. You can improve your business’s tax position by using Section 179 to expense the full cost of qualifying equipment in 2020. By taking advantage of Section 179, you are reducing your taxable income and creating tax savings.

Limitations of IRS Section 179

IRS Section 179 permits qualifying equipment and software purchases, up to $1,040,000, to be fully deducted in year one. This deduction is available for the 2020 tax year via the American Taxpayer Relief Act and can provide tremendous tax savings to participating businesses. Please be aware, however, that IRS Section 179 can change year-to-year. That said, be sure to take advantage of this tax code while it is still available.

Innovation Finance USA, LLC is not an authorized tax advisor. You must consult your tax advisor, visit irs.gov or contact the IRS helpline at 800.289.4933 to confirm whether or not you qualify for this tax benefit.