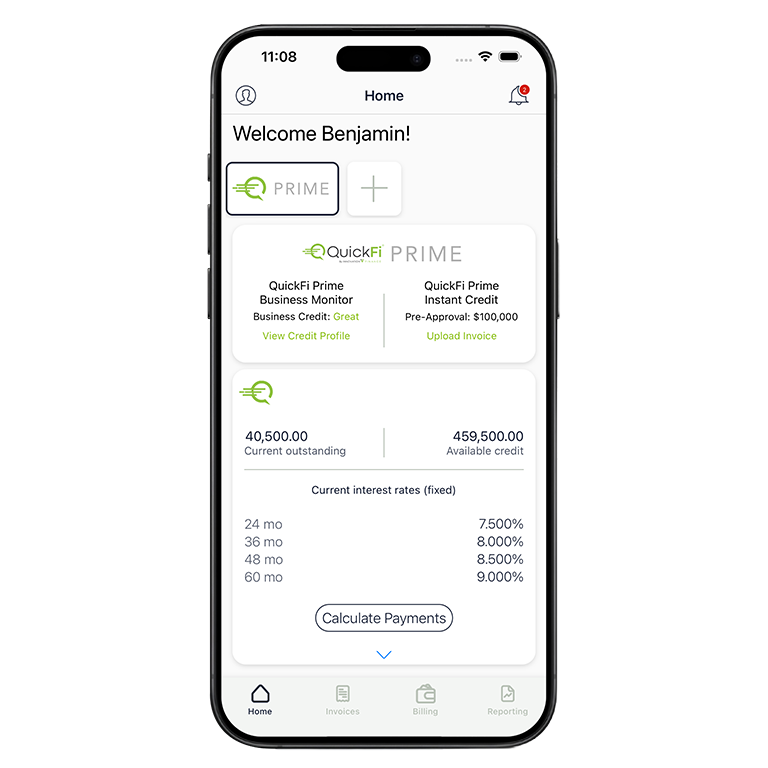

QuickFi PRIME Features

QuickFi PRIME provides you with a business line of credit, access to your business and personal credit reports, suggestions to help improve your credit availability, and more.

Your business has a credit line to finance qualifying new business equipment at exceptional, low fixed rates with no hidden fees or costs.

Just as you’d view your personal credit report to check your financial history, the same information can be reviewed for your business. QuickFi PRIME helps your business monitor its business credit information from multiple credit reporting agencies.

Building business credit can be confusing. QuickFi PRIME helps you understand and improve your business credit, empowering you to obtain more competitive financing. Of course, continued prompt payments on your loans initiated through QuickFi are reported to agencies to help you continue to expand your business profile.

QuickFi PRIME Pricing

FIRST YEAR

FREE

Enjoy QuickFi PRIME FREE throughout 2025, subject to your repayment performance and business credit history.

OPTIONAL EXTENSION OF QUICKFI PRIME

| $25

PER MONTH |

$249

PER YEAR |

Continue this powerful new finance tool into 2026 to help you grow your business faster, with the lowest rate business equipment financing available. Control of your business credit and establish an equipment financing line-of-credit to facilitate your future business growth.