Planning your next purchase?

Use the QuickFi quote tool.

Use the QuickFi quote tool.

Having the right equipment can increase the number of treatment options your clinic can offer to patients and achieve improved outcomes for a better patient experience. Savvy practice managers and practitioners weigh out financial options before making any major equipment purchase. Having a tool at your fingertips to plan effectively can help you determine the cost benefit of everything from new computers & EHR software to new imaging solutions like X-ray, ultrasound, or archiving systems.

Knowing exactly what you’re going to pay versus the amount of revenue you can generate is a simple way to determine the ROI of your new machine and treatment offering. Breaking down a monthly payment to an amount that you know your revenue will cover is an easy way to bake in ROI for all of your equipment purchases, and stay profitable while investing in new equipment.

According to data gathered by NerdWallet, an average MRI scan costs $2,600. If the average cost for a new MRI system is $350,000, building out a financing plan where the number of scans you do covers your monthly payment allows you to add a revenue stream while maintaining profitability. Investing in this MRI becomes an operational cost covered by your new revenues.

The QuickFi app offers you a quick and easy way to plan out future equipment purchases right in the app. Your up-to-date rate is always provided, so you know exactly what your fixed monthly payment is going to be. Build in profitability when you are planning your purchases.

With our custom quote function, we want to give you the tools for planning a profitable practice. Take the quote from our app, use it to create deals, or even use it to compare it to our competition! We want you to have the best overall experience in equipment lending, and give you the transparency to operate efficiently.

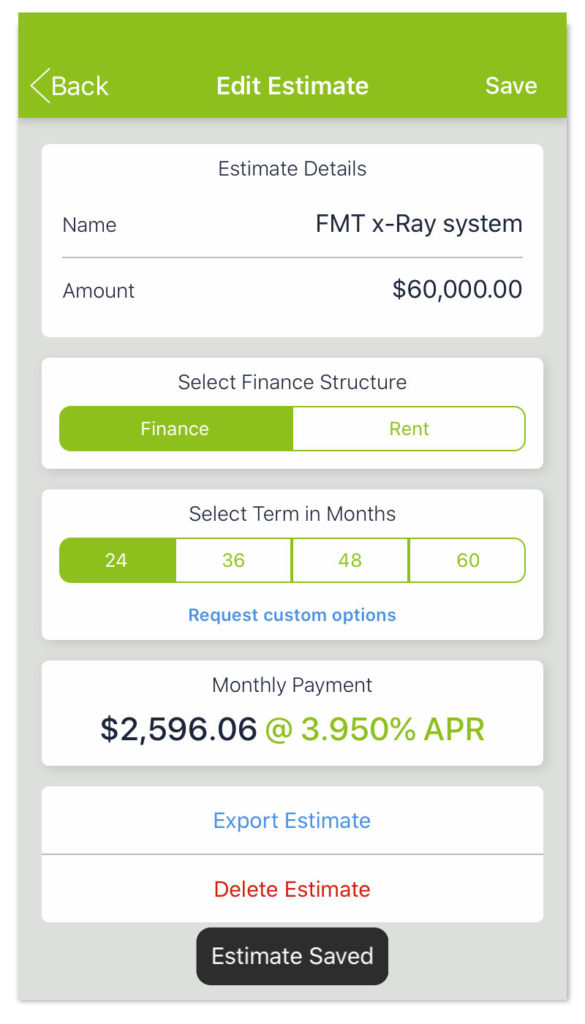

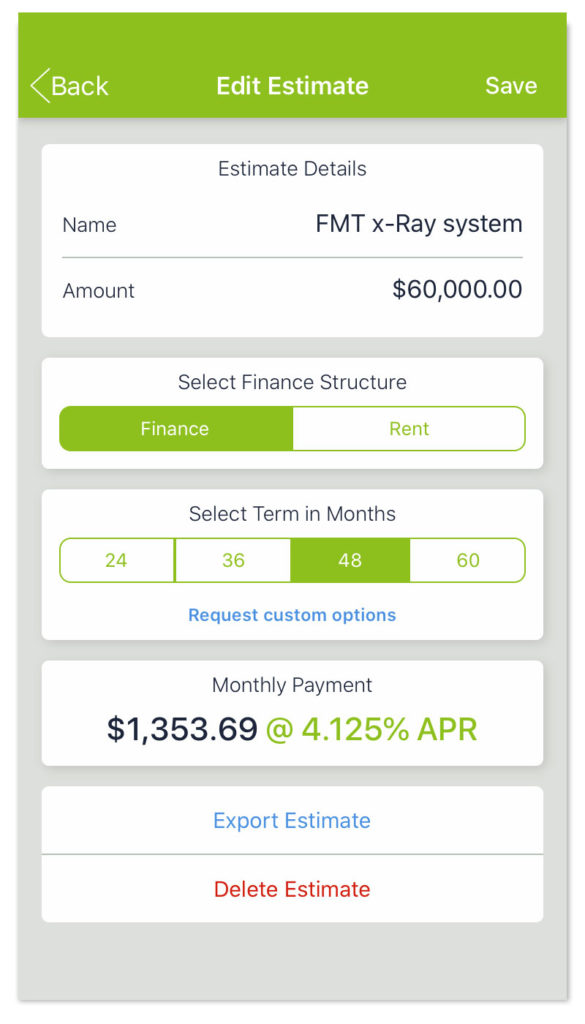

Price out any new equipment you are planning to get, and get down to the dollar details on what your term & structure is going to be.

You are working with your fixed-rate so there are no surprises. Customize the deal according to your needs.

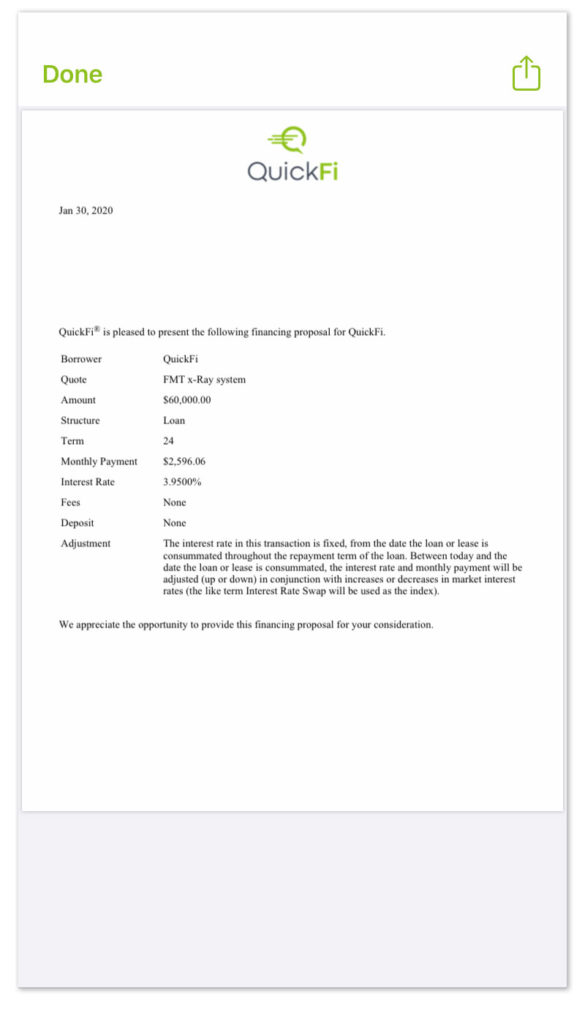

If you need to send out your quote to your team, do it quickly and digitally all within the app. It’s a great tool to compare quotes.

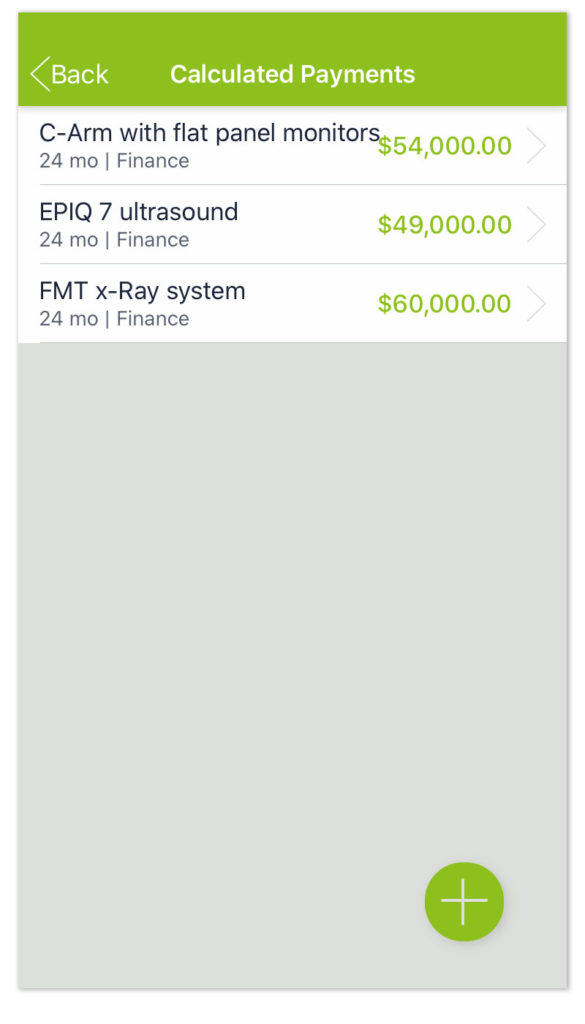

Plan all upcoming purchases and see what you have the budget for. Create your wishlist and know exactly how much it will cost.

No matter what your strategy for revenue growth in 2020, investing in health tech and patient-centric innovation will continue to drive urgent care clinics forward. Providers who embrace the right health tech tools and equipment will be able to remain competitive and profitable in 2020 and well beyond.

As you consider what equipment and technology you want to invest in to create a better patient experience, don’t let financing hang you up. Plan your next deal with QuickFi, 24/7. Download the app, and gain full control over your equipment financing, and get the health tech equipment you need to maintain profitability, predictability & quality of care, and patient experience.

The Latest Innovation Updates

What new medical equipment would you acquire with low-rate equipment financing?

How can your urgent care clinic stand out in 2020 and beyond?

Don’t fall victim to aggressive salesmanship, hidden costs, or fees.