Transform your organization with a B2B embedded equipment finance platform.

QuickFi is an end-to-end loan and lease servicing platform, eliminating our partners’ need to manage complex equipment leasing software systems and eliminating costly servicing, collection, customer service, IT, security and other staff costs.

With reduced operating cost, faster cycle times, and improved borrower satisfaction, QuickFi increases both bottom and top line equipment financing performance.

Trusted by the world's leading equipment manufacturers

|

|

|

|

|

Why do banks and OEMs use QuickFi?

QuickFi gives partners advanced financing capabilities not available elsewhere. SMB customers use QuickFi to self-serve business equipment financing loans and leases from anywhere, at any time of the day or night. The self-service, 100% digital QuickFi platform costs a fraction of the cost of the legacy delivery model, while providing a faster, dramatically preferred borrower experience. With reduced operating cost, faster cycle times, and improved borrower satisfaction, QuickFi increases both bottom and top line equipment financing performance.

QuickFi is an end-to-end loan and lease servicing platform, eliminating partner banks’ need to manage complex equipment leasing software systems and eliminating costly servicing, collection, customer service, IT, security and other staff costs.

How it works

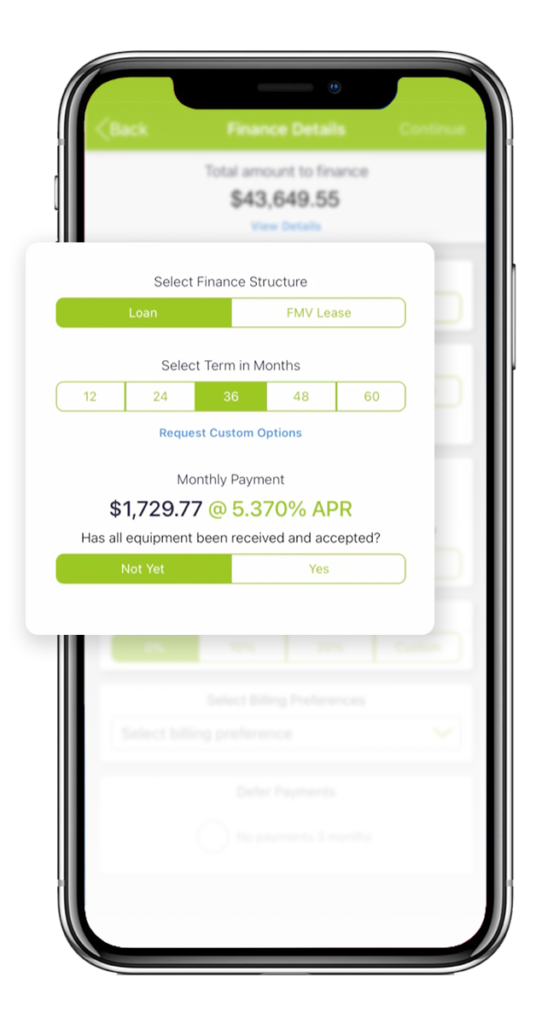

QuickFi gives your company the ability to offer your business borrowers access to low, fixed-rate equipment financing anytime (24/7) on the world’s only 100% digital, mobile business equipment financing platform. Our 100% digital QuickFi mobile platform enables 24/7 customer self-service, three-minute transaction processing, and next day funding.

Your customers can get complete financing for your equipment in less than 3 minutes.

Simple application Your customer enters a few pieces of information, and onboards with a seamless, secure experience for a real-time decision.

Flexible terms & payments Customers pick their payment plan, with low, fixed-rate options ranging from 12–72 months.

Revolutionary customer experience Customers know exactly what they’ll owe, with no fees or hidden costs and no surprises.

|

|

|

|

|

|

|

|