Accelerate your equipment sales

Business equipment manufacturers can adopt the end-to-end, 100% digital, QuickFi business equipment financing platform to sell more equipment, faster, while dramatically improving the equipment buyer’s experience.

Trusted by the world’s leading equipment manufacturers

|

|

Why do Equipment Manufacturers Love QuickFi?

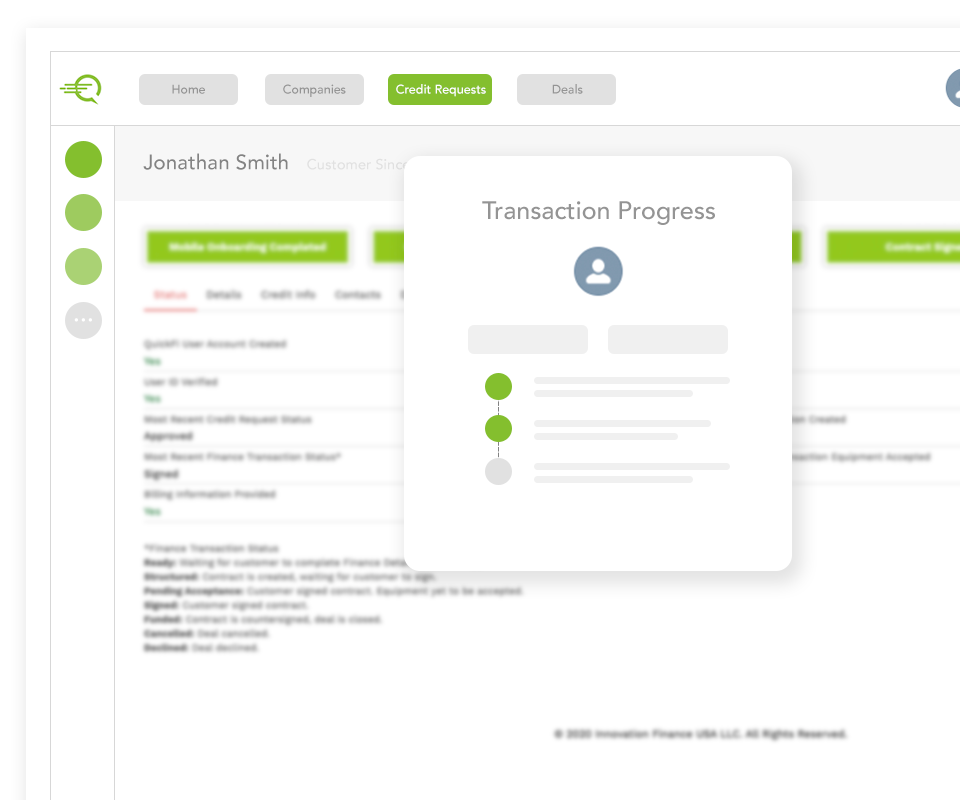

QuickFi® by Innovation Finance USA LLC, is the world’s first 100% digital, mobile, borrower-self-service business equipment financing platform. QuickFi enables business equipment buyers to almost instantly establish and consummate business equipment leases and loans ranging from $5,000 to $5,000,000 USD. Leading equipment manufacturers use the patented QuickFi system to initiate and complete equipment purchaser financing in just 3 minutes.

QuickFi’s patented technologies include biometric authentication, drivers’ license verification, AI/ML, blockchain, and other advanced security, mobile and cloud technologies. QuickFi reduces equipment manufacturer sale cycle times by dramatically simplifying and accelerating the financing process.

Manufacturer integrated financing solutions

QuickFi gives business equipment manufacturers advanced financing capabilities not available elsewhere. Pre-approve business equipment purchasers (without cost or obligation) on every potential sale, to increase closing rates, shorten timing to close, and to improve product sale margin. With pre-approval capabilities, QuickFi partners close more sales, faster, at higher margin.

Accelerate your equipment sales

Fast, simple rollout

Finance online equipment sales

The QuickFi Difference

No upfront cost – no long-term commitment — pay only for funded transactions — hold the loans and leases yourself, or outsource the entire financing process to QuickFi.

Leverage experienced credit underwriting, customer support, operations, risk, compliance, billing, collections and accounting expertise — without expensive software investments in legacy, non-digital software platforms — by establishing a single, 100% digital business partnership with QuickFi.

Implement a 100% digital platform (incorporating facial recognition, drivers’ license authentication, artificial intelligence, blockchain, and other cloud & mobile technologies) white-labeled with your brand and managed by your organization.

Obtain 24/7/365 equipment financing capabilities to support your sales channels

What our partners are saying

“We’re excited about the benefits for our dealers and valued customers with this Sany – QuickFi partnership. Transactions that previously took days or weeks can now be completed in minutes, anytime day or night.”

Scott M., Area Sales Manager at Atlas Copco

“To have this ability

to go into a customer

and say you’re pre

approved, that’s what

closed this second deal

… to say to the customer

you’re pre-approved,

and nothing is holding

you back.”

“We are excited to offer our customers more financing options with the Quickfi digital equipment financing platform.”

About QuickFi

QuickFi incorporated emerging new technologies (such as artificial intelligence, facial recognition, and blockchain) to create an entirely new financing business model expediting the equipment sale process with advanced pre-qualification capabilities instant 24/7 credit and documentation processing and next day funding — all with a nearly instant, dramatically improved borrower experience.

QuickFi provides significant differentiation and competitive advantage against all manufacturers employing the traditional equipment financing model.