Future-proof your bank as new commercial financing disclosure requirements are implemented

Providers of commercial financing that are subject to new state commercial finance disclosure laws must provide disclosures to potential recipients of commercial financing at the time a specific offer of financing is extended to a recipient, pursuant to new regulations adopted by various state agencies. These disclosure requirements are being enacted to regulate commercial lending like consumer lending in states including New York, California, Utah, Virginia, Connecticut, Florida, and Georgia.

More laws are likely. So far this year, the following states have proposed various forms of CFDLs: Illinois (Senate Bill 2234 and House Bill 3064), Kansas (Senate Bill 245), Maryland (Senate Bill 496), Mississippi (Senate Bill 2619 and House Bill 1271, both of which have since failed), Missouri (Senate Bill 187 and House Bill 584), North Carolina (Senate Bill 539 and House Bill 662) and Texas (Senate Bill 1918 and House Bill 4359, both of which have since failed). New Jersey’s CFDL remains pending during the carry-over session (Senate Bill 819 and House Bill 2150). If last year’s legislative session is any indication of what may be expected this year, many other proposals may be forthcoming including a possible bill at the federal level.

These regulations are part of a broader trend to bring transparency to commercial lending, to correct decades of abusive practices in small business commercial lease and loan terms. Business owners, often met with equipment financing contracts that conceal a variety of hidden costs, including interim rent, deposits, fees, and abusive practices like not offering prepayment discounts, are seeking broader protections that consumer loans are afforded. A recent Wall Street Journal Article outlined the problems small and medium business owners face with current commercial financing practices.

Scope of Commercial Lending Disclosure Requirements

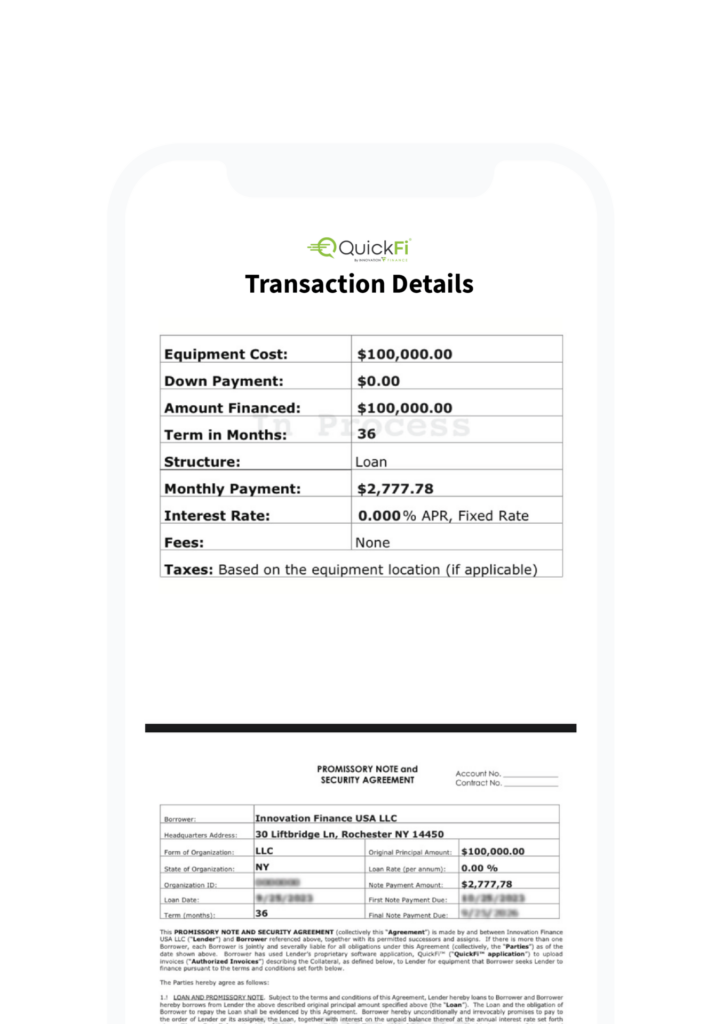

“Providers” of commercial financing are required to furnish key loan terms, such as Amount Financed, APR, and Finance Charge, to loan “recipients.” Disclosure requirements apply to any loan the proceeds of which the recipient does not intend to use primarily for personal, family, or household purposes. For purposes of determining whether a transaction is “commercial,” the regulations stipulate that a provider may rely on the representations of the recipient.

Florida Commercial Finance Disclosure

Effective Date: January 1, 2024

Georgia Commercial Finance Disclosure

Effective Date: January 1, 2024

Connecticut Commercial Finance Disclosure

New York Commercial Finance Disclosure

Effective Date: February 1, 2023

Utah Commercial Finance Disclosure

Effective Date: January 1, 2023

California Commercial Finance Disclosure

Effective Date: December 19, 2022

Virginia Commercial Finance Disclosure

Effective Date: October 1, 2022

The disclosures must be provided at the time an offer is extended. Disclosures vary by state, but mostly must include the:

- (i) total amount financed;

- (ii) finance charge (both total and itemized);

- (iii) APR;

- (iv) estimated term of financing;

- (v) total repayment amount;

- (vi) amount and frequency of payments;

- (vii) description of all other potential fees and charges;

- (viii) prepayment charges; and

- (ix) description of any collateral requirements or security interests.

The regulations add category-specific rules for the computation of the finance charge and the APR, and further stipulate that the charge should be calculated to exclude “avoidable fees and charges that are not imposed as an incident of credit.”

In addition to providing the disclosure, providers must obtain recipients’ signatures on the disclosure before proceeding further with the application process. The regulations further clarify the signature requirements, including those for electronic signature.

Failure to comply with these disclosures does come at a cost. In New York, pursuant to the CFDL, DFS may impose civil penalties on providers for any violations of the CFDL, with fines not to exceed $2,000 per violation or $10,000 for any intentional violations. It may also order an injunction if it finds a provider has knowingly violated the law.

Digital Solutions for Commercial Lending Disclosure Requirements

Adopting digital self-service solutions can help your bank comply with existing state disclosure requirements for commercial financing, and scale efficiently as new requirements are passed.

Having a digital, scalable onboarding infrastructure and workflow allows your bank to account for state and location-based variables, and offer different disclosures based on self-reported business location criteria to ensure compliance with new regulations. The digital onboarding allows for the effective scaling of disclosures for every state systematically as they roll out. Working these variables into your digital onboarding can have other long-term benefits, like compliance with Section 1071 of Dodd-Frank based on dollar thresholds, and criteria set up by regulatory bodies like the CFPB.

Adopting a digital infrastructure also allows your bank to integrate best-in-class technology to streamline and automate bank KYB, KYC, identity verification and AML/BSA policies at the point of application.

Along with these disclosure requirements and customer preferences evolving with the rapid evolution of consumer finance technology, the market is gravitating towards transparent offerings with disclosed APR, disclosed fees and charges, and simple English contracts that are borrower friendly. Offering commercial banking products that are borrower-friendly, with an emphasis on the borrower experience, and partnering with technology providers that have the same philosophy, will be vital to ensuring the success of your bank into the future.