Embedded Equipment Finance

Embedded finance is the integration of financial services into non-financial offerings. It is changing the way customers interact with banks and financial institutions.

Examples of embedded finance include e-commerce merchants providing insurance, a fast-food restaurant offering 1-click payments, and retail white-labeled credit card. Embedded finance solutions meet the customer at the time and place where there is an opportunity to fill a financial need. Loans, insurance, or payment processing are common examples.

Embedded finance represents a transition from traditional financial sales to borrower self-service at the point of sale. The transition from traditional sales business models to digital borrower self-service is well underway; however, business equipment financing (a $1.34 trillion per year U.S. market1) still operates almost entirely on a 50-year-old traditional sales delivery model.

REPORTS REFERENCED

Accenture | Embedded Finance for SMEs: Banks & Digital platforms

Bain & Company | Embedded Finance: What It Takes to Prosper in the New Value Chain

McKinsey & Company | Embedded finance: Who will lead the next payments revolution?

In a report on embedded finance for SMEs, Accenture found that embedded finance represents a $32 billion lost revenue opportunity if banks do nothing. For banks that adopt a new, borrower-self-service embedded finance strategy, it represents a $92 billion dollar expanded market opportunity by 2025.

Bain and Company suggest that embedded finance will primarily impact payments and lending. According to Bain,

The rise of embedded finance marks a new era, not only for banking transactions but also for how consumers and businesses build and manage relationships with financial services more broadly.

… These developments herald a transformative financial moment. Embedded finance enables customers to have a new type of relationship with financial providers, giving them access to services as a by-product of the software they use and the goods they consume. While some companies will hesitate and possibly miss out on the opportunities, others will take the lead and figure out how to reap the benefits. This report explores these benefits and how firms can capture them.

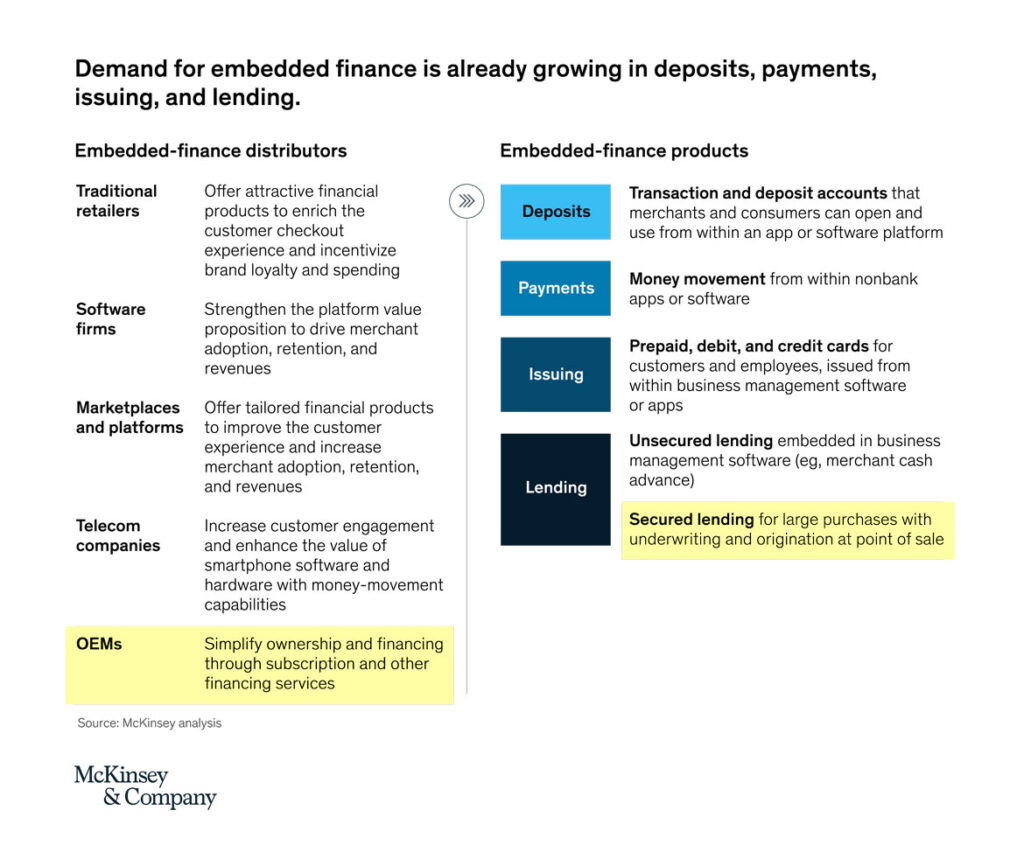

Embedded finance improves the customer experience and unlocks massive cost savings and repeat business potential. McKinsey & Company says, “Among embedded-finance distributors and their end customers, demand is already maturing for a range of deposit, payment, issuing, and lending products (see McKinsey & Company Exhibit 1, below).

McKinsey & Company adds, “Despite the scale of this opportunity, many banks, payments providers, fintechs, investors, software firms, and potential distributors are unsure what embedded finance involves, how they can participate, and what it takes to win—questions we address in this article.”

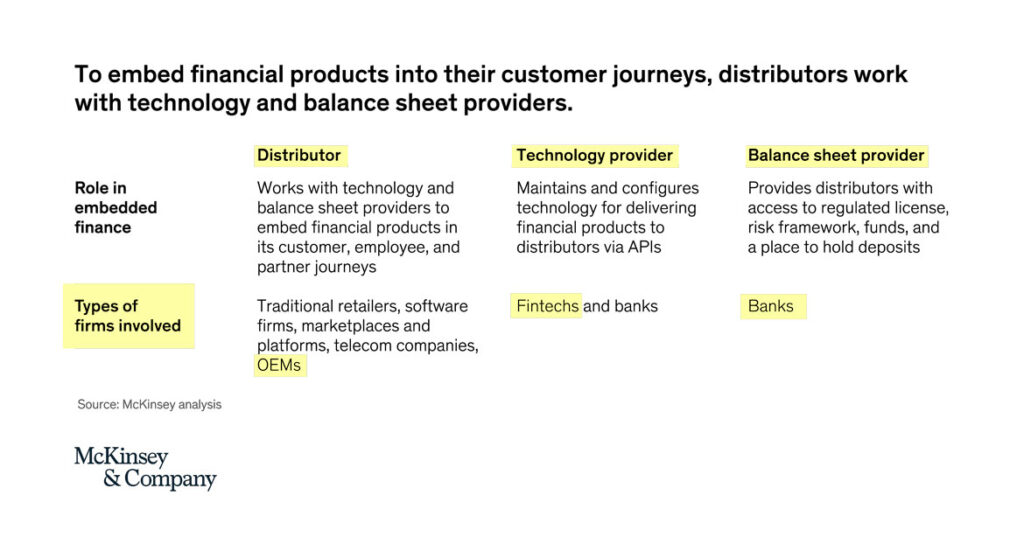

Like Bain & Company, McKinsey and Company also predicts that OEMs, Fintechs, and Banks will come together to establish new embedded finance delivery models (See McKinsey & Company Chart 2, above).

Accenture suggested,

“Embedded specialty financing—lending and leasing—is coming. In fact, I think it’s a trend that’s likely to change the finance landscape within the next five years. So, auto and equipment finance companies need to start thinking now about how they can capitalize on it for the best advantage.”

Cameron Krueger, Managing Director – Specialty Finance, Accenture

For original equipment manufacturers (OEMs) and their finance partners, embedded finance means nearly instant financing at the point of sale, resulting in a dramatically improved buying experience and expanded repeat business and digital marketing potential. OEM equipment sales professionals are empowered to direct equipment purchasers into sophisticated, self-service mobile platforms offering instant digital financing at any time of the day or night.

Over the next five years, embedded finance for SMEs will displace traditional sales distribution models. Bain and Company suggest, “Demand [for embedded finance] will grow because the proposition promises to improve customer experiences and financial access, along with providing cost-reduction.” Now is the time for banks and OEMs to decide how they will offer embedded equipment finance.

Schedule a meeting today to learn more about implementing an embedded equipment finance solution.