TRENDS

Do Rapidly Changing Consumer Preferences Foreshadow Changes in Commercial Lending?

Do Rapidly Changing Consumer Preferences Foreshadow Changes in Commercial Lending?

In recent years, consumer financial preferences have changed the way customers interact with financial institutions. Salesperson-driven communications have been displaced by self-service digital exchanges. Seamless interfaces deliver personalized service with more convenience and speed.

If consumer expectations influence the B2B market, here are 4 customer financial trends that may shape the future of commercial lending:

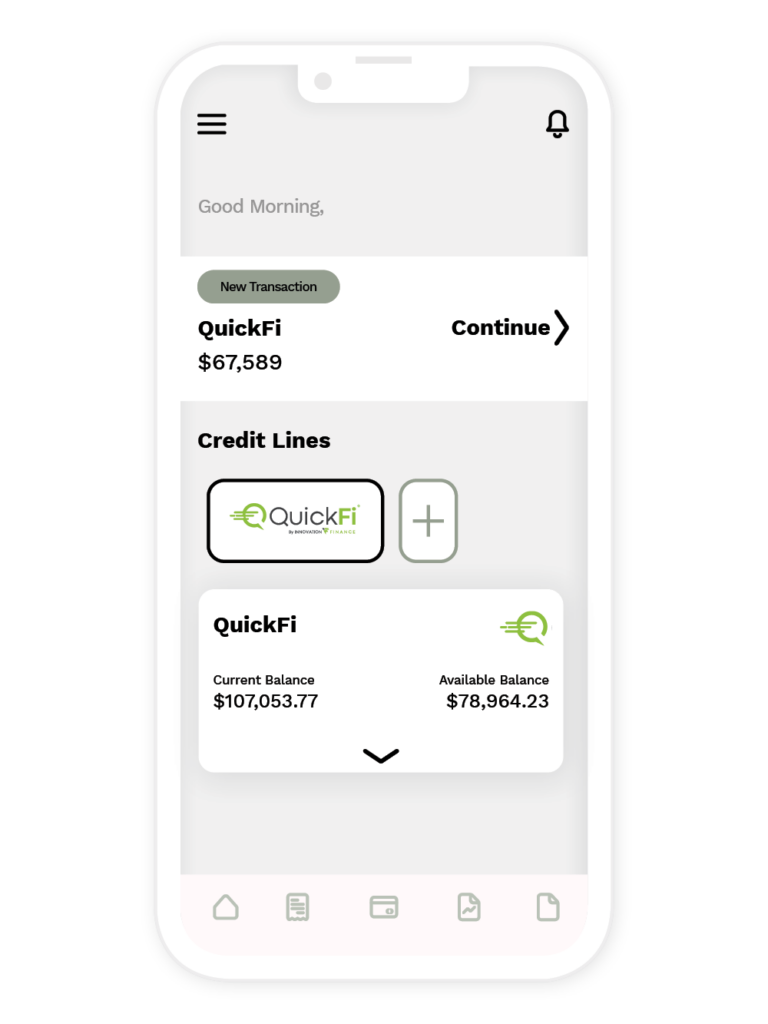

- Mobile Experience: Customers prefer transacting on mobile devices, without salespeople or the requirement to transact at the time and location specified by the lender. Mobile financial applications are becoming more sophisticated, offering users a wide range of features and capabilities beyond the experiences available in legacy sales and distribution channels. A recent Forbes Advisor survey indicates that the tides have shifted, and the majority of Americans are now on board with digital banking. As of 2022, 78% of adults in the U.S. prefer to bank via a mobile app or website. Only 29% of Americans prefer to bank in person.

- AI-Powered Marketing, Personalization and Credit Capabilities: Banks have the potential to use artificial intelligence (AI) to market, personalize, and more efficiently deliver loans to business borrowers. AI algorithms can analyze customer behavior, financial data, and preferences to provide tailored product offerings, customer support, and advice. According to a survey from The Economist Intelligence Unit, 77% of bankers believe that the ability to unlock the value of AI will be the difference between the success or failure of banks. Before banks can initiate most of these capabilities, they need to pivot to a borrower self-service delivery model to connect customers directly to bank systems.

- Omnichannel Equipment Sales: Original Equipment Manufacturers (OEMs) may soon provide shopping experiences across multiple channels. Customers increasingly prefer the convenience, variety, and accessibility offered by e-commerce platforms. According to recent data from Statista on B2B e-commerce, US manufacturing B2B e-commerce sales reached $623 Billion dollars, and that figure stands to grow as more companies are planning to transform digital services and e-commerce infrastructure. Embedded digital financing represents the future for serving such manufacturers and their customers.

- API-Driven, Open Banking: Customers have a better view of their financial data, thanks in large part to API-driven data access across multiple mircoservices. Open banking initiatives allow third-party developers to access bank data and provide services through secure APIs. This API-driven strategy facilitates innovative new financial applications, benefiting borrowers with increased options at the point of sale. A recent McKinsey global survey on APIs in banking revealed that 81% of respondents think APIs are a priority for business and IT functions. Large banks are launching API programs and allocating on average 14% of their IT to budget to API development. As open banking expands from Europe to the U.S., the pace of financial innovation will increase. Banks that don’t partner or innovate risk being left behind in a rapidly evolving marketplace.

Is your commercial lending business equipped for the future?